What's Hanpass Card?

Page Info.

Writer HANPASS

HANPASS

25-03-11

57

0

2

본문

Hello! Let me introduce Hanpass Card!

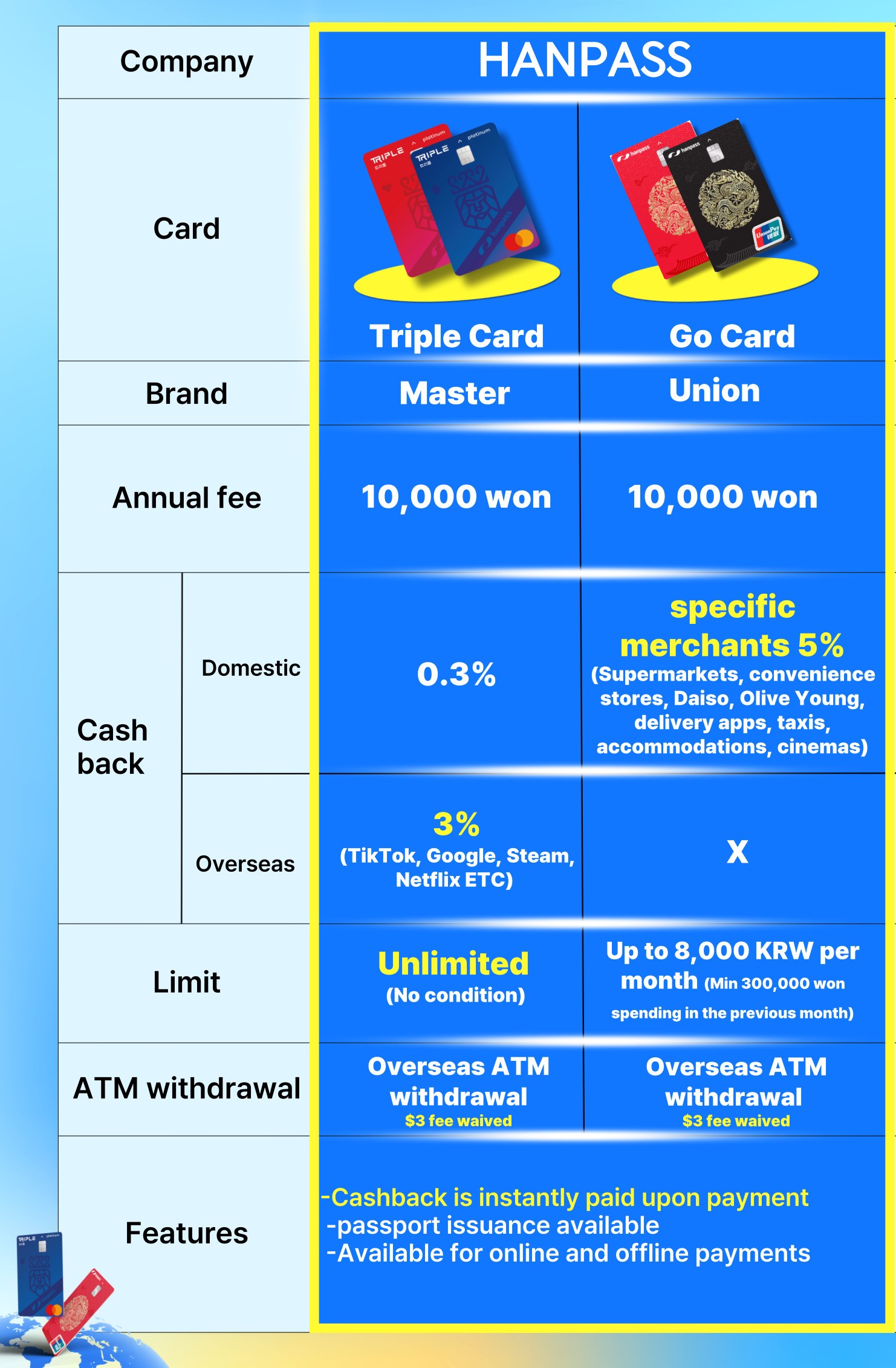

Hanpass offers two types of cards, each with different features.

Choose the one that best suits your needs!

<Common Features of Triple Card & GO Card>

Both cards have an annual fee of 10,000 KRW

*Deducted from the wallet on the 10th of the following month after issuance

Convenient prepaid cards (debit cards) that can be easily issued through the Hanpass Wallet mobile app.

KRW balance is checked at the time of card approval → Cashback is instantly credited.

Ideal for customers who need both overseas remittance and card payments

*e.g., students studying abroad, travelers

Can be used for both online and offline payments.

*Note: Online payments are unavailable on websites that require a foreign registration number.

After traveling in Korea, the remaining balance can be sent to an overseas bank account or picked up as cash.

Cash withdrawals are available not only in Korea but at ATMs worldwide.

*Overseas ATM withdrawal fee of $3 is free (additional surcharges may apply depending on the ATM).

Triple Card <Special Benefits>

3% Cashback on Overseas Payments

*No spending requirements

*Applies to international transactions such as Netflix, YouTube, Amazon, etc., even in Korea

0.3% Cashback on Domestic Payments

*No spending requirements

Accepted at Mastercard merchants overseas (Accepted at BC Card merchants in Korea)

GO Card <Special Benefits>

5% Cashback on Domestic Payments at convenience stores, supermarkets, Olive Young, Daiso, etc.

*For the first month after issuance, there is no spending condition

*Cashback condition: Spend at least 300,000 KRW per month to receive the cashback benefit (maximum of 8,000 KRW per month).

UnionPay Card Benefits Available

Accepted at UnionPay merchants overseas (Accepted at BC Card merchants in Korea)

Sign up for Hanpass now and apply for your card today!!

Hanpass offers two types of cards, each with different features.

Choose the one that best suits your needs!

<Common Features of Triple Card & GO Card>

Both cards have an annual fee of 10,000 KRW

*Deducted from the wallet on the 10th of the following month after issuance

Convenient prepaid cards (debit cards) that can be easily issued through the Hanpass Wallet mobile app.

KRW balance is checked at the time of card approval → Cashback is instantly credited.

Ideal for customers who need both overseas remittance and card payments

*e.g., students studying abroad, travelers

Can be used for both online and offline payments.

*Note: Online payments are unavailable on websites that require a foreign registration number.

After traveling in Korea, the remaining balance can be sent to an overseas bank account or picked up as cash.

Cash withdrawals are available not only in Korea but at ATMs worldwide.

*Overseas ATM withdrawal fee of $3 is free (additional surcharges may apply depending on the ATM).

Triple Card <Special Benefits>

3% Cashback on Overseas Payments

*No spending requirements

*Applies to international transactions such as Netflix, YouTube, Amazon, etc., even in Korea

0.3% Cashback on Domestic Payments

*No spending requirements

Accepted at Mastercard merchants overseas (Accepted at BC Card merchants in Korea)

GO Card <Special Benefits>

5% Cashback on Domestic Payments at convenience stores, supermarkets, Olive Young, Daiso, etc.

*For the first month after issuance, there is no spending condition

*Cashback condition: Spend at least 300,000 KRW per month to receive the cashback benefit (maximum of 8,000 KRW per month).

UnionPay Card Benefits Available

Accepted at UnionPay merchants overseas (Accepted at BC Card merchants in Korea)

Sign up for Hanpass now and apply for your card today!!

추천0

Links

- https://m.site.naver.com/1CNXi 15 Connection

댓글목록

jar12님의 댓글

****** Date Posted

![]() This comment is visible only to the post author and the commenter.

This comment is visible only to the post author and the commenter.

HANPASS님의 댓글의 댓글

****** Date Posted

![]() This comment is visible only to the post author and the commenter.

This comment is visible only to the post author and the commenter.